According to analysis by Cushman & Wakefield, Asia Pacific is forecasted to surpass the United States as the largest colocation data center market globally before 2030.

The Asia Pacific Data Centre Investment Landscape report predicts that by 2030, the region will have around 23,904 MW of operational colocation capacity, compared to the United States, which is expected to have approximately 18,256 MW. This will position APAC ahead of the US in both capacity and projected rental revenue.

Pritesh Swamy, Head of Insights and Analysis for Cushman & Wakefield’s Asia Pacific Data Centre Group, commented on the findings:

“Various forecast models show that Asia Pacific will overtake the United States as the largest colocation market in either 2028 or 2029. Based on the population differential, this is expected—but still significant given the depth and maturity of the US market.”

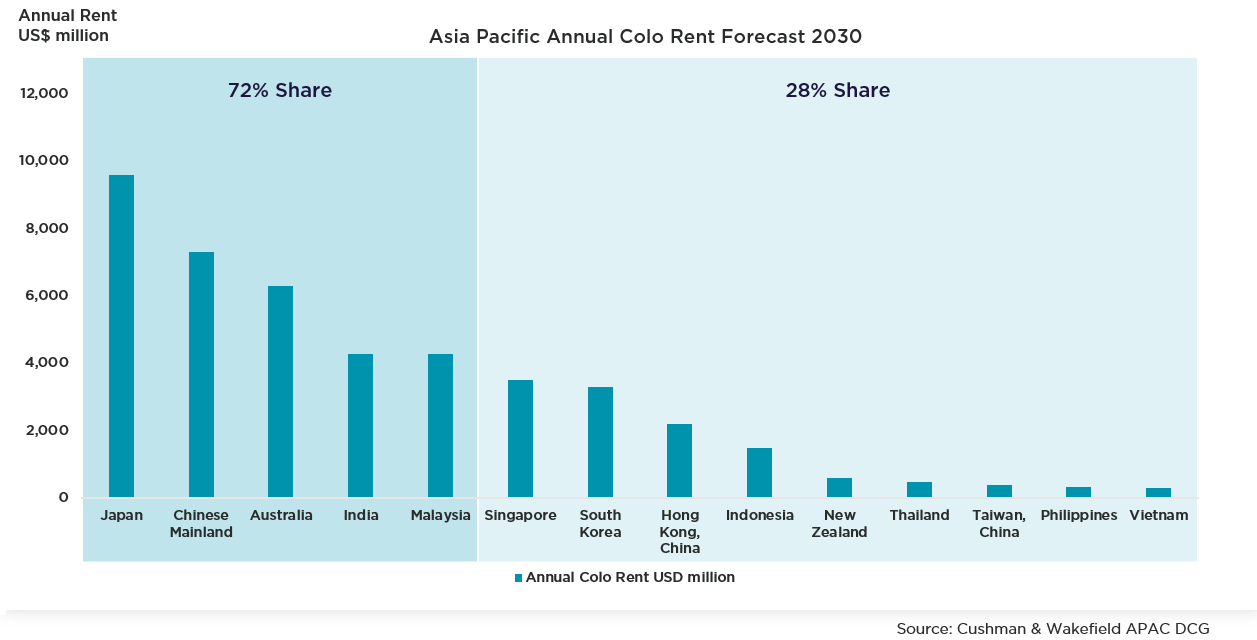

The report also forecasts that APAC’s colocation rental income will reach approximately USD $44 billion annually by 2030, with 72% of this revenue coming from the region’s five largest markets: Japan, China, Australia, India, and Malaysia. Additionally, Malaysia is projected to replace Singapore as the fifth largest market around 2029.

Japan is expected to lead these markets, contributing 22% of regional colocation revenue, which amounts to an estimated USD $9.6 billion by 2030. The other four major markets are also anticipated to generate more than USD $4 billion annually in colocation revenue.

Changing Development Profiles

Cushman & Wakefield’s analysis highlights differences in operational approaches between APAC and the US. Swamy remarked on the capacity distribution:

“Asia Pacific’s higher proportion of operational colocation capacity, combined with higher average colo rents on a per kW basis, helped to drive the region’s average rental rates above those in the US.”

Currently, 58% of operational data center capacity in the United States is colocation stock, while in Asia Pacific, the figure is 85%. The report indicates this gap will gradually narrow throughout the decade.

By 2030, colocation facilities are expected to make up 86% of operational capacity in APAC, while in the US, this share will increase to 61%. The report suggests that colocation capacity in the US will continue to grow, with hyperscale cloud and AI providers increasingly relying on colocation services to meet rising demand.

Market indicators

The Asia Pacific Data Centre Investment Landscape report aggregates data from 14 regional markets and considers factors such as population per megawatt of data center capacity, regional demand, US investment into APAC, capital expenditure needs, rent revenue, cap rates, and yield on cost.

Population growth, increasing digitalization, and robust regional economic activity are identified as key drivers of rising demand and investment in data center infrastructure across Asia Pacific.

The forecasted growth in capacity and revenue is expected to lead to shifts in investment patterns, with private and institutional investors focusing more on the APAC data center sector.